Teringat nak update pasal unit trust ni..tersebok dgn makan2 raya sana sini ..tiba2 ada kawan YM tanya ..”mcm mana unit trust hang?”

Saya ingin tekan kan di sini..bila masuk unit trust ni..kena ada sifat SABAR ..ni bukan masuk hari ni..bulan depan nampak dah untung..kalau nak jenis cepat untung saya sangat2 tidak rekomen menjurumus dalam unit trust…kalau nak cepat ..saya cadangkan main FCPO ..hahahha tu lagik sakit jantung..tak tido lena…ada nasib baik sehari untung beratus2 ..

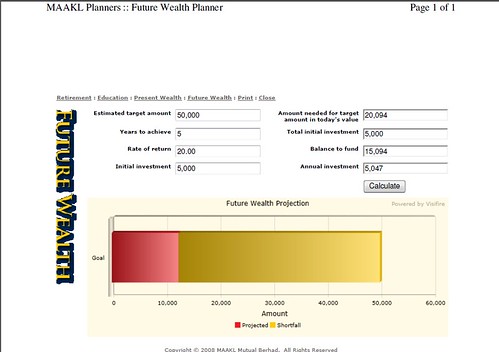

Ok ni contoh plan proposal utk masa depan ..contoh client target 50k ..so saya pon buat analisis guna tools maakl yg hebat tu hehehhe ..saya estimate 20% return setahun ..igt tu..anggaran saja..

Daripada gambaran jadual di atas..jika anda target nak ada 50k dalam masa 5 tahun ,anda mula dgn rm5000 ,dan bulanan topup rm420 ..tu saya tak masukkan kesan inflasi dalam jadual di atas..ada jugak jadual apabila iflasi 3% diambil kira ..

Yg penting kena SABAR dan BERTERUSAN ..

Kite mula merancang dari sekarang..saya boleh tolong analisis utk fund education anak2 berdasarkan kos pendidikan di negara2 tertentu .. ,utk persaraan,,utk simpanan ….boleh ym saya (anamusa80) atau emel anamusa80 at yahoo dot com

Saya tinggalkan anda dgn soalan ini...

“Should you put your EPF money

in unit trusts, and if so, in what

proportion?

If you can, you should put your EPF

money into unit trusts. The type of

unit trusts would depend on your

risk profile and when you need the

money. Generally, the younger you

are, the higher proportion of equity

investments you can have. Even if you

retire at 55, you still have 20 or 30

years ahead of you, so there is still a

small portion of funds you can use to

ride on the higher growth potential

of equities. “

~source personal money mac 2002~

No comments:

Post a Comment